10 Michigan Tax Calculator Tips To Save Money

When it comes to managing your finances, understanding how to navigate tax calculations is crucial. For residents of Michigan, utilizing a Michigan tax calculator can be a significant step in optimizing your financial planning. A Michigan tax calculator is a tool designed to help individuals and businesses estimate their tax liability based on their income, deductions, and credits. Here are 10 tips to make the most out of a Michigan tax calculator and potentially save money on your taxes.

Understanding Michigan Income Tax

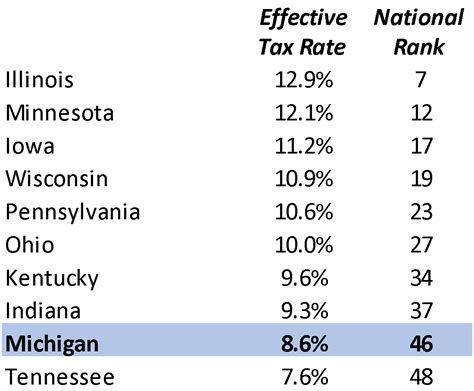

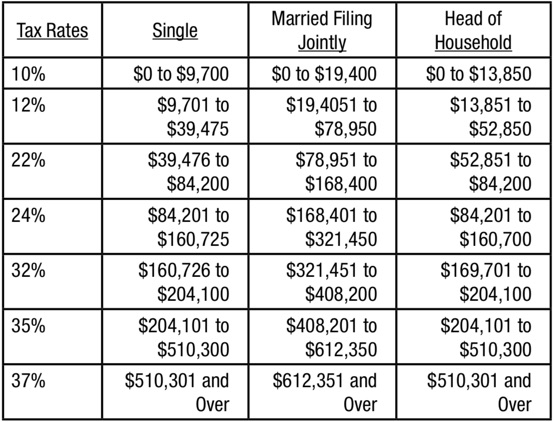

Michigan has a flat income tax rate of 4.25%. This means that regardless of your income level, you will be taxed at this rate. However, there are deductions and credits available that can reduce your taxable income. A Michigan tax calculator can help you identify these opportunities. For instance, claiming deductions for charitable donations, mortgage interest, and property taxes can significantly reduce your taxable income. Additionally, tax credits such as the Earned Income Tax Credit (EITC) for low-to-moderate-income working individuals and families can directly reduce the amount of tax you owe.

Tip 1: Accurately Report Income

Ensuring that you accurately report all sources of income is vital. This includes wages, salaries, tips, and income from self-employment. Underreporting income can lead to penalties and fines, while overreporting can result in overpaying taxes. A Michigan tax calculator can help you organize your income sources and ensure you’re reporting accurately. Keeping detailed records of your income throughout the year can make this process easier.

Tip 2: Max Out Deductions

Deductions can significantly reduce your taxable income. Common deductions include itemized deductions for medical expenses, state and local taxes, and home mortgage interest. A Michigan tax calculator can help you determine whether itemizing deductions or taking the standard deduction is more beneficial for your situation. Itemizing deductions requires careful tracking of eligible expenses throughout the year.

Tip 3: Claim Eligible Credits

Beyond deductions, tax credits can provide a dollar-for-dollar reduction in your tax liability. Michigan offers several tax credits, including the Homestead Property Tax Credit for eligible homeowners and renters. A Michigan tax calculator can guide you through the eligibility criteria for these credits and help you claim them if you qualify.

| Tax Credit | Eligibility Criteria | Maximum Credit |

|---|---|---|

| Homestead Property Tax Credit | Homeowners and renters with household income below certain thresholds | Varies based on income and tax paid |

| Earned Income Tax Credit (EITC) | Low-to-moderate-income working individuals and families | Up to several thousand dollars, depending on income and family size |

Planning for Retirement and Education

Michigan also offers tax-advantaged savings options for retirement and education. Contributions to a 401(k) or IRA can reduce your taxable income, while 529 college savings plans offer tax benefits for saving for higher education expenses. Understanding how these savings vehicles interact with your tax situation can help you optimize your financial strategy.

Tip 4: Utilize Tax-Advantaged Savings

Tax-advantaged savings plans such as 401(k), IRA, and 529 plans can help you save for retirement and education while reducing your tax liability. Contributions to these plans may be deductible, and the earnings grow tax-deferred. A Michigan tax calculator can help you see the impact of these contributions on your tax bill.

Tip 5: Consider Consulting a Tax Professional

While a Michigan tax calculator is a powerful tool, tax laws and individual circumstances can be complex. Consulting a tax professional can provide personalized advice tailored to your situation, potentially uncovering additional savings opportunities that you might overlook on your own.

Staying Informed About Tax Law Changes

Tax laws and regulations are subject to change. Staying informed about these changes can help you adjust your financial planning to maximize your savings. A Michigan tax calculator that is updated regularly can reflect these changes and provide you with the most current information to make informed decisions.

Tip 6: Regularly Update Your Tax Strategy

Tax laws evolve, and what was beneficial one year may not be the next. Regularly reviewing and updating your tax strategy with the help of a Michigan tax calculator can ensure you’re always taking advantage of the most current opportunities to save.

Tip 7: Take Advantage of Tax Credits for Education

Beyond savings plans, there are tax credits available for education expenses, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. These credits can directly reduce your tax liability dollar for dollar and are claimable for eligible education expenses.

Tip 8: Claim the Child Tax Credit

The Child Tax Credit is a significant tax credit for families with qualifying children under the age of 17. This credit can be worth up to $2,000 per child, depending on your income level. A Michigan tax calculator can help determine if you’re eligible and how much you can claim.

Tip 9: Explore Business Deductions

If you’re self-employed or own a business, you may be eligible for business deductions that can significantly reduce your taxable income. This includes deductions for business use of your home, travel expenses, and equipment purchases. Accurately calculating these deductions with a Michigan tax calculator can help ensure you’re taking full advantage of the deductions you’re eligible for.

Tip 10: Review and Adjust Annually

Your financial situation and tax laws can change from year to year. Annually reviewing your tax strategy with a Michigan tax calculator and adjusting as necessary can help you stay on top of your tax planning and ensure you’re always optimizing your savings.

What is the Michigan income tax rate?

+Michigan has a flat income tax rate of 4.25%. This rate applies to all taxable income, regardless of the amount.

How do I claim the Homestead Property Tax Credit?

+To claim the Homestead Property Tax Credit, you must meet certain eligibility criteria, including owning or renting a Michigan homestead and having household income below certain thresholds. You can claim this credit when filing your Michigan income tax return using a Michigan tax calculator to guide you through the process.

Can I deduct charitable donations on my Michigan tax return?

+Yes, charitable donations are deductible on your Michigan tax return. You can itemize these donations and other eligible expenses to reduce your taxable income. A Michigan tax calculator can help you calculate the total value of your deductions.