What Are Bonos De Ioma? Expert Investment Guide

Bonos de Ioma, also known as Ioma bonds, are a type of investment product offered by the Instituto de Obra Médico Asistencial (Ioma), a healthcare institution in the province of Buenos Aires, Argentina. These bonds are designed to provide investors with a fixed income stream while supporting the institution's healthcare activities. In this expert guide, we will delve into the world of Bonos de Ioma, exploring their features, benefits, and risks, as well as providing an in-depth analysis of their investment potential.

Introduction to Bonos de Ioma

Bonos de Ioma are a type of debt security issued by Ioma to finance its healthcare programs and infrastructure development. These bonds are typically denominated in Argentine pesos and offer a fixed interest rate, which is paid periodically to investors. The interest rate and repayment terms are predetermined, making Bonos de Ioma an attractive option for investors seeking predictable returns. The institution’s strong credit history and commitment to healthcare development have contributed to the popularity of these bonds among investors.

Key Features of Bonos de Ioma

Some of the key features of Bonos de Ioma include:

- Fixed interest rate: Bonos de Ioma offer a fixed interest rate, which is paid periodically to investors.

- Fixed repayment term: The repayment term is predetermined, providing investors with a clear understanding of when their principal investment will be returned.

- Low risk: As a debt security issued by a reputable institution, Bonos de Ioma are considered a low-risk investment option.

- Liquidity: Bonos de Ioma can be traded on the secondary market, providing investors with the flexibility to sell their bonds before maturity.

In addition to these features, Bonos de Ioma also offer tax benefits, as the interest earned is exempt from certain taxes. This makes them an attractive option for investors seeking to minimize their tax liability.

| Feature | Description |

|---|---|

| Interest Rate | Fixed, ranging from 4% to 8% per annum |

| Repayment Term | Fixed, ranging from 1 to 5 years |

| Minimum Investment | ARG 10,000 (approximately USD 150) |

| Maximum Investment | ARG 1,000,000 (approximately USD 15,000) |

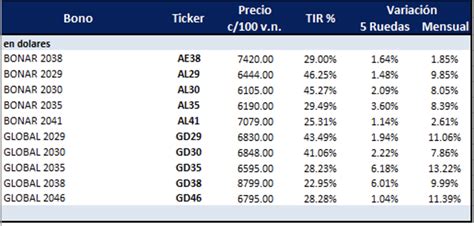

Investment Analysis

To determine the investment potential of Bonos de Ioma, it’s crucial to analyze their yield to maturity, which takes into account the interest rate, repayment term, and credit risk. A higher yield to maturity indicates a higher potential return on investment. Additionally, investors should consider the credit rating of Ioma, which reflects the institution’s creditworthiness and ability to repay its debts.

A comparison of Bonos de Ioma with other investment options in Argentina, such as time deposits and government bonds, reveals that they offer a competitive yield to maturity. However, investors should be aware of the currency risk associated with investing in Argentine pesos, as fluctuations in the exchange rate can impact the value of their investment.

Risks and Challenges

While Bonos de Ioma are considered a low-risk investment option, there are still some risks and challenges to be aware of:

- Credit risk: Although Ioma has a strong credit history, there is still a risk that the institution may default on its debt obligations.

- Interest rate risk: Changes in interest rates can impact the value of Bonos de Ioma, making them less attractive to investors.

- Liquidity risk: While Bonos de Ioma can be traded on the secondary market, there may be limited liquidity, making it difficult to sell the bonds quickly.

What is the minimum investment required for Bonos de Ioma?

+The minimum investment required for Bonos de Ioma is ARG 10,000 (approximately USD 150).

Are Bonos de Ioma a good investment option for foreign investors?

+Bonos de Ioma can be a good investment option for foreign investors seeking to diversify their portfolio and gain exposure to the Argentine market. However, it's essential to consider the currency risk and other challenges associated with investing in Argentine pesos.

In conclusion, Bonos de Ioma are a type of investment product that offers a fixed income stream and supports the healthcare activities of Ioma. While they are considered a low-risk investment option, it’s essential to be aware of the potential risks and challenges, including credit risk, interest rate risk, and liquidity risk. By carefully evaluating the features and benefits of Bonos de Ioma, investors can make an informed decision about whether this investment product aligns with their financial goals and risk tolerance.