Veterans Copay: Understanding Incomebased Benefits

Veterans Copay, a term that often arises in discussions about veteran healthcare benefits, is an essential aspect of the US Department of Veterans Affairs (VA) healthcare system. This comprehensive guide aims to shed light on the incomebased benefits program, a critical component designed to make healthcare more accessible and affordable for veterans. By understanding the intricacies of this program, veterans can better navigate the VA healthcare system and make informed decisions about their healthcare coverage.

The Incomebased Benefits Program: An Overview

The Incomebased Benefits (IB) program is a vital initiative within the VA healthcare system, offering financial assistance to veterans based on their income and family size. This program ensures that veterans with limited financial means can access the medical care they need without facing significant financial barriers.

The IB program is particularly crucial for veterans who may not qualify for other VA healthcare benefits or who have exceeded their coverage limits. By considering an individual's income, the VA can offer tailored copayment rates, making healthcare more affordable and ensuring that veterans receive the necessary medical attention.

Eligibility Criteria

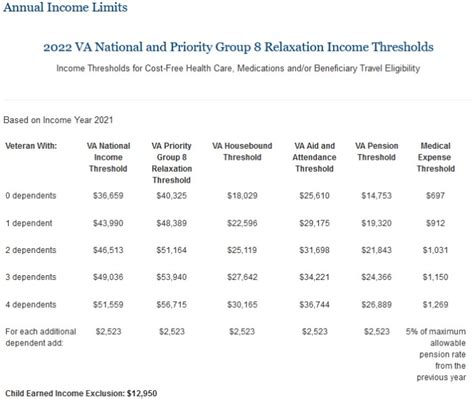

Veterans who wish to apply for incomebased benefits must meet specific eligibility criteria. These criteria include having a service-connected disability rating of at least 50% or a nonservice-connected disability pension. Additionally, veterans must have an annual income that falls below the VA’s income threshold, which is adjusted annually based on the Cost of Living Allowance (COLA) and other economic factors.

It's important to note that the VA uses a complex formula to calculate incomebased benefits, taking into account not only the veteran's income but also their family size and certain allowable deductions. This ensures that the benefits are tailored to the individual's financial situation, providing a more equitable distribution of healthcare resources.

Application Process

To apply for incomebased benefits, veterans can visit their local VA medical center or reach out to the VA’s Health Benefits Service Center. The application process typically involves submitting financial documentation, such as tax returns and pay stubs, to verify the veteran’s income and family size. The VA will then assess the application and determine the appropriate copayment rate based on the veteran’s financial circumstances.

It's crucial for veterans to provide accurate and up-to-date financial information during the application process. Any discrepancies or inaccuracies in the financial documentation can lead to delays in processing or even denial of the application. Therefore, veterans should ensure that they have all the necessary documents ready before initiating the application process.

Understanding Copayment Rates

Copayment rates are a central component of the incomebased benefits program. These rates determine the amount veterans must pay out of pocket for their healthcare services. The VA sets these rates based on a veteran’s income and family size, ensuring that the copayments are proportionate to their financial means.

Copayment Categories

The VA categorizes veterans into different copayment categories based on their financial circumstances. These categories include:

- Category 1: Veterans with an annual income below a certain threshold and no dependents.

- Category 2: Veterans with an annual income below the threshold but with one or more dependents.

- Category 3: Veterans with an annual income above the threshold but still eligible for incomebased benefits due to exceptional circumstances.

Each category has a specific copayment rate associated with it, ensuring that veterans pay a fair and manageable amount for their healthcare services. The VA regularly reviews and adjusts these rates to reflect changes in the cost of healthcare and the economic climate.

Waivers and Exemptions

In certain situations, veterans may be eligible for copayment waivers or exemptions. For instance, veterans who are 100% service-connected disabled or who have a catastrophic disability may be exempt from copayments entirely. Additionally, veterans who are participating in certain VA programs, such as the Veterans Choice Program, may also be eligible for copayment waivers.

It's important for veterans to understand their eligibility for waivers and exemptions, as these can significantly reduce their out-of-pocket expenses. Veterans should consult with their VA healthcare provider or the VA's Health Benefits Service Center to determine if they qualify for any such waivers or exemptions.

Veterans Copayment and Healthcare Services

The Veterans Copayment program covers a wide range of healthcare services, ensuring that veterans have access to comprehensive medical care. These services include:

- Primary Care: Veterans can receive regular check-ups, screenings, and treatment for common health issues through primary care services.

- Specialty Care: For more specialized medical needs, veterans can access specialty care services, such as cardiology, oncology, and mental health services.

- Pharmaceuticals: The VA's pharmaceutical program provides veterans with access to prescription medications at reduced copayment rates, making it more affordable to manage chronic conditions.

- Emergency Care: In case of medical emergencies, veterans can receive urgent care services through the VA's emergency departments or authorized private healthcare providers.

- Dental and Vision Care: The VA also offers limited dental and vision care services, helping veterans maintain their oral and eye health.

It's important for veterans to understand the scope of services covered by the Veterans Copayment program to make the most of their healthcare benefits. By utilizing these services, veterans can proactively manage their health and well-being, ensuring a higher quality of life.

Performance Analysis and Feedback

The VA regularly assesses the performance of the incomebased benefits program to ensure its effectiveness and make necessary improvements. This involves gathering feedback from veterans, healthcare providers, and other stakeholders to identify areas for enhancement.

One of the key performance indicators is the satisfaction level of veterans with the incomebased benefits program. The VA conducts surveys and collects feedback to gauge veterans' experiences with the program, including their perception of the copayment rates, ease of application process, and overall accessibility of healthcare services.

Continuous Improvement

Based on the feedback and performance analysis, the VA implements various initiatives to improve the incomebased benefits program. These initiatives may include simplifying the application process, enhancing the accuracy of income verification, and expanding the range of healthcare services covered by the program.

The VA also collaborates with veteran service organizations and community partners to raise awareness about the incomebased benefits program and ensure that veterans are informed about their healthcare options. By working together, these organizations can help veterans navigate the complex VA healthcare system and access the benefits they deserve.

Future Implications and Innovations

As the healthcare landscape continues to evolve, the VA is committed to staying at the forefront of innovation to better serve veterans. The incomebased benefits program is no exception, with ongoing efforts to enhance its effectiveness and accessibility.

Digital Transformation

The VA is embracing digital transformation to streamline the application process for incomebased benefits. By developing user-friendly online platforms and mobile applications, veterans can apply for benefits and manage their healthcare accounts more conveniently. This digital shift not only improves efficiency but also enhances the overall user experience.

Data-Driven Decision Making

The VA is leveraging data analytics to make more informed decisions about the incomebased benefits program. By analyzing large datasets, the VA can identify trends, assess the impact of policy changes, and make data-driven adjustments to improve the program’s effectiveness. This approach ensures that the VA’s healthcare benefits remain responsive to the evolving needs of veterans.

Expanding Partnerships

To enhance the reach and accessibility of the incomebased benefits program, the VA is actively seeking partnerships with private healthcare providers and community organizations. By expanding its network of authorized providers, the VA can offer veterans more options for receiving healthcare services, particularly in rural or underserved areas.

Additionally, the VA is exploring collaborations with academic institutions and research organizations to conduct studies and gather evidence-based insights into the impact of incomebased benefits on veteran health outcomes. These partnerships will help the VA make evidence-based decisions and further improve the program's design and implementation.

Conclusion

The Veterans Copay program, particularly the incomebased benefits component, plays a crucial role in ensuring that veterans have access to affordable and high-quality healthcare. By understanding the eligibility criteria, application process, and copayment rates, veterans can make informed decisions about their healthcare coverage. The VA’s commitment to continuous improvement and innovation ensures that the incomebased benefits program remains a vital and effective component of the VA healthcare system, providing much-needed support to veterans across the nation.

How often are incomebased benefits reviewed and adjusted?

+The VA reviews and adjusts incomebased benefits annually, taking into account economic factors such as the Cost of Living Allowance (COLA) and changes in the cost of healthcare. This ensures that the benefits remain relevant and affordable for veterans.

Can veterans appeal their copayment rates if they feel they are unfair?

+Yes, veterans have the right to appeal their copayment rates if they believe they are inaccurate or unfair. The VA has a dedicated appeals process in place, allowing veterans to provide additional financial documentation or evidence to support their case.

Are there any income thresholds for incomebased benefits eligibility?

+Yes, the VA sets income thresholds based on the veteran’s family size and other factors. These thresholds are reviewed and adjusted annually to ensure that the program remains accessible to veterans with limited financial means.