Usaa Mortgage Rates: Save On Your Dream Home

When it comes to financing your dream home, securing the best mortgage rate is crucial. USAA mortgage rates offer competitive options for members of the military, veterans, and their families. Understanding the current market and available rates can help you make an informed decision. As of the latest data, USAA mortgage rates range from 4.25% to 6.5% APR for a 30-year fixed-rate mortgage, depending on your credit score, loan amount, and other factors.

Overview of USAA Mortgage Rates

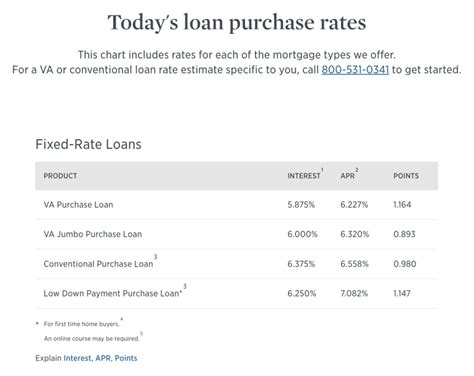

USAA is known for its member-centric approach, providing exclusive benefits to those who have served or are currently serving in the military, as well as their spouses and children. The organization offers a variety of mortgage products, including fixed-rate and adjustable-rate loans, VA loans, and jumbo loans. Fixed-rate mortgages provide stability with consistent monthly payments, while adjustable-rate mortgages can offer lower initial rates but may increase over time. VA loans, guaranteed by the Department of Veterans Affairs, often come with more favorable terms, such as lower or no down payment requirements and competitive interest rates.

Mortgage Rate Comparison

Comparing mortgage rates among different lenders is essential to find the best deal. The following table illustrates a comparison of USAA mortgage rates with other major lenders in the market:

| Lender | 30-Year Fixed Rate | 15-Year Fixed Rate |

|---|---|---|

| USAA | 4.25% - 6.5% APR | 3.75% - 6.0% APR |

| Bank of America | 4.5% - 7.0% APR | 4.0% - 6.5% APR |

| Wells Fargo | 4.75% - 7.25% APR | 4.25% - 6.75% APR |

It's clear that USAA offers competitive rates, especially for its target demographic. However, rates can fluctuate based on market conditions, so it's vital to check the current rates and consider factors like loan terms, fees, and your personal financial situation when making a decision.

Factors Affecting USAA Mortgage Rates

Several factors can influence the mortgage rate you’re offered by USAA, including your credit score, loan-to-value (LTV) ratio, debt-to-income ratio, and the type of property you’re purchasing. Maintaining a good credit score, keeping your debt manageable, and opting for a lower LTV ratio can help you qualify for better rates.

Benefits for Military Members and Veterans

USAA’s mortgage products are tailored to benefit military members, veterans, and their families. One of the significant advantages is the VA loan option, which can offer better terms than conventional loans. Additionally, USAA often provides lower interest rates and reduced fees for its members, making homeownership more accessible.

For example, with a VA loan, you may not need to make a down payment, and you won't have to pay private mortgage insurance (PMI), which can significantly reduce your monthly mortgage payments. USAA also offers a Military Mortgage Payment Relief program, designed to help members who are experiencing financial hardship due to military service.

What are the eligibility requirements for USAA membership?

+To be eligible for USAA membership, you must be an active, retired, or honorably separated officer or enlisted personnel of the U.S. military, or the spouse or child of such a member. Cadets and midshipmen at U.S. service academies, in advanced ROTC, or on ROTC scholarship are also eligible.

How do I apply for a USAA mortgage?

+You can apply for a USAA mortgage by visiting the USAA website, calling the USAA mortgage hotline, or working with a USAA mortgage loan officer. You'll need to provide financial information, including your income, credit history, and details about the property you wish to purchase.

In conclusion, USAA mortgage rates offer competitive options for those who are eligible for membership. By understanding the factors that influence these rates and taking advantage of the benefits tailored for military members and veterans, you can make an informed decision that helps you achieve your dream of homeownership.

Future Implications and Considerations

As the housing market and interest rates continue to evolve, it’s essential to stay informed about the latest trends and how they might impact your mortgage. Economic factors, such as inflation and employment rates, can influence interest rates. Additionally, government policies and regulatory changes can affect the mortgage industry, potentially altering the landscape of available loan products and rates.

Staying up-to-date with market analysis and considering factors like refinancing options and mortgage insurance can help you navigate the complexities of homeownership and make the most of your investment. USAA’s commitment to its members, combined with its competitive mortgage rates and tailored benefits, positions it as a valuable resource for those seeking to purchase or refinance a home.