Paycheck Calculator Nc: Calculate Takehome Pay

The paycheck calculator NC is a valuable tool for employees in North Carolina to determine their take-home pay. Understanding the components that affect take-home pay is essential for effective financial planning. In this article, we will delve into the specifics of calculating take-home pay in North Carolina, considering factors such as gross income, taxes, and deductions.

Understanding Gross Income and Its Impact on Take-Home Pay

Gross income is the total amount of money earned by an individual before any deductions or taxes are applied. It includes wages, salaries, tips, and any other form of compensation. To calculate take-home pay, it’s crucial to start with the accurate gross income figure. In North Carolina, the average salary varies significantly depending on the profession, location, and industry. For instance, a software engineer in Raleigh might have a higher gross income compared to a teacher in a smaller town.

Taxation in North Carolina: How It Affects Take-Home Pay

North Carolina imposes a state income tax, which currently stands at 4.99% for the 2023 tax year. This tax rate applies to all taxable income, and it’s essential to consider it when calculating take-home pay. Additionally, federal income taxes also apply, ranging from 10% to 37%, depending on the tax bracket. The combination of state and federal taxes significantly impacts the take-home pay, making it necessary to account for these deductions accurately.

Federal income tax brackets are adjusted annually for inflation, and understanding these brackets is vital for accurate tax planning. Similarly, state income tax rates can change, so it's essential to stay updated on the latest tax laws in North Carolina. For the 2023 tax year, the federal income tax brackets are as follows:

| Taxable Income | Tax Rate |

|---|---|

| $0 - $11,000 | 10% |

| $11,001 - $44,725 | 12% |

| $44,726 - $95,375 | 22% |

| $95,376 - $182,100 | 24% |

| $182,101 - $231,250 | 32% |

| $231,251 - $578,125 | 35% |

| $578,126 and above | 37% |

Deductions and Benefits: Their Role in Take-Home Pay Calculation

Beyond taxes, various deductions and benefits can significantly affect take-home pay. These include health insurance premiums, 401(k) contributions, and other pre-tax deductions. Pre-tax deductions reduce the taxable income, thereby decreasing the amount of taxes owed. However, they also reduce the take-home pay. It’s essential to balance these deductions with the need for a higher take-home pay. Additionally, post-tax deductions, such as garnishments or union dues, are deducted after taxes and do not affect the taxable income but still impact the take-home pay.

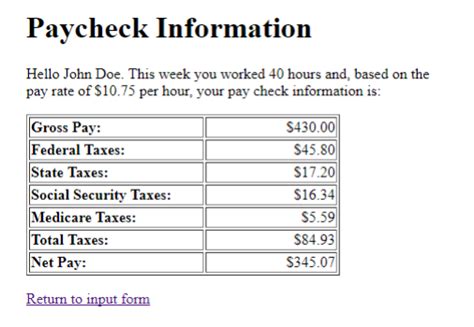

Calculating Take-Home Pay: A Step-by-Step Guide

To calculate take-home pay, follow these steps:

- Determine the gross income from all sources.

- Calculate federal and state income taxes based on the taxable income and relevant tax brackets.

- Account for pre-tax deductions, such as health insurance premiums and 401(k) contributions.

- Apply post-tax deductions, if any.

- Subtract the total deductions and taxes from the gross income to find the take-home pay.

Utilizing a paycheck calculator NC can simplify this process by automatically calculating taxes and deductions based on the input provided. These calculators are especially useful for employees who receive irregular income or have complex tax situations.

How does the paycheck calculator NC account for overtime pay?

+The paycheck calculator NC considers overtime pay as part of the gross income. It calculates the overtime pay based on the provided regular hours, overtime hours, and the applicable overtime rate. This ensures that the take-home pay calculation is accurate, reflecting both regular and overtime income.

Can the paycheck calculator NC handle complex tax scenarios, such as multiple jobs or self-employment income?

+Yes, advanced paycheck calculators can accommodate complex tax scenarios, including multiple jobs, self-employment income, and investments. They allow users to input detailed information about their income sources and deductions, providing a more accurate take-home pay estimate. For highly complex situations, consulting a tax professional may still be necessary to ensure all factors are considered.

In conclusion, calculating take-home pay in North Carolina involves considering gross income, taxes, deductions, and benefits. By understanding these components and utilizing tools like the paycheck calculator NC, employees can gain a clearer picture of their financial situation. This knowledge enables them to make informed decisions about their income, plan for the future, and navigate the complexities of the tax system effectively.