Illinois Pay Calculator: Accurate Takehome Pay

The Illinois pay calculator is a valuable tool for employees and employers alike, providing accurate take-home pay calculations based on the state's tax laws and regulations. Illinois, being one of the states with a flat income tax rate, currently imposes a tax rate of 4.95% on all taxable income. However, to accurately calculate take-home pay, it's essential to consider other factors such as federal income taxes, deductions, and exemptions.

Understanding Illinois Income Tax

Illinois has a flat state income tax rate, which simplifies the calculation of state taxes compared to states with progressive tax systems. The flat rate applies to all taxable income, regardless of the amount earned. For the 2022 tax year, the state income tax rate in Illinois is 4.95%. This rate applies to both single and joint filers, with no distinctions based on filing status or income level.

Federal Income Taxes and Their Impact

Federal income taxes play a significant role in determining an individual’s take-home pay. The federal income tax system is progressive, meaning tax rates increase as income rises. There are seven federal income tax brackets, ranging from 10% to 37%, and the tax rate applied depends on the individual’s taxable income. For accurate calculations, it’s crucial to consider both state and federal taxes, as well as any deductions or exemptions that may apply.

| Illinois State Income Tax Rate | Flat Rate |

|---|---|

| 2022 Tax Year | 4.95% |

| Federal Income Tax Brackets (2022) | Tax Rates |

| 10% | $0 - $9,875 (Single), $0 - $19,750 (Joint) |

| 12% | $9,876 - $40,125 (Single), $19,751 - $80,250 (Joint) |

| 22% | $40,126 - $80,250 (Single), $80,251 - $171,050 (Joint) |

| 24% | $80,251 - $164,700 (Single), $171,051 - $326,600 (Joint) |

| 32% | $164,701 - $214,700 (Single), $326,601 - $414,700 (Joint) |

| 35% | $214,701 - $518,400 (Single), $414,701 - $622,050 (Joint) |

| 37% | $518,401 and above (Single), $622,051 and above (Joint) |

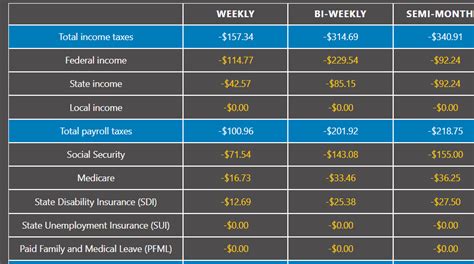

Calculating Take-Home Pay in Illinois

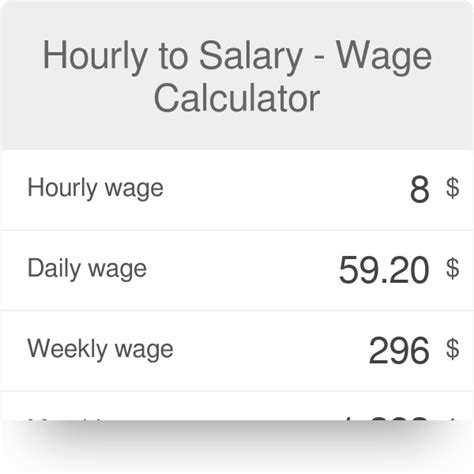

To calculate take-home pay in Illinois, one must consider gross income, deductions, exemptions, and both state and federal tax rates. The process involves:

- Determining gross income from all sources.

- Applying deductions and exemptions to arrive at taxable income.

- Calculating state income tax using the flat rate of 4.95%.

- Calculating federal income tax based on the applicable tax bracket.

- Subtracting total taxes (state and federal) from gross income to find net income or take-home pay.

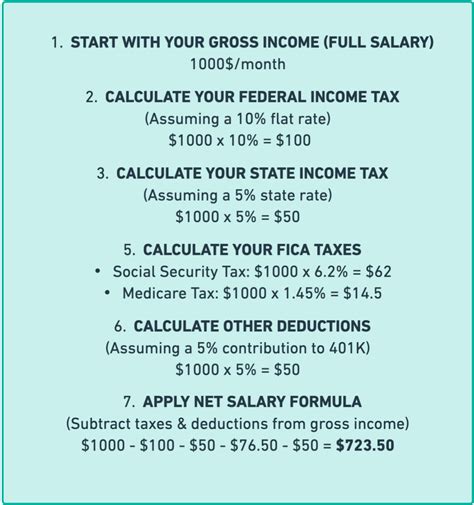

Example Calculation

Consider an individual with a gross income of 60,000, filing single with no dependents, and taking the standard deduction of 12,950 for the 2022 tax year.

1. Gross Income: 60,000</p> <p>2. Deductions (Standard Deduction): 12,950

3. Taxable Income: 60,000 - 12,950 = 47,050</p> <p>4. State Income Tax (4.95% of 47,050): 2,329.975</p> <p>5. Federal Income Tax (assuming 22% tax bracket for simplicity): approximately 8,331 (actual calculation would depend on the specific tax bracket and other factors)

6. Total Taxes: 2,329.975 (state) + 8,331 (federal) = 10,660.975</p> <p>7. Take-Home Pay: 60,000 - 10,660.975 = 49,339.025

Impact of Deductions and Exemptions

Deductions and exemptions can significantly reduce taxable income, thereby lowering the amount of taxes owed and increasing take-home pay. Common deductions include the standard deduction, itemized deductions (such as mortgage interest and charitable donations), and deductions for retirement savings contributions. Exemptions, such as the personal exemption (though currently suspended), can also reduce taxable income.

Standard Deduction vs. Itemized Deductions

The standard deduction is a fixed amount that can be subtracted from income without needing to itemize deductions. For the 2022 tax year, the standard deduction is 12,950 for single filers and 25,900 for joint filers. Itemized deductions, on the other hand, involve listing specific expenses that qualify for a tax deduction, such as medical expenses, state and local taxes (SALT), and mortgage interest. Choosing between the standard deduction and itemized deductions depends on which results in a lower taxable income.

| 2022 Standard Deduction | Amount |

|---|---|

| Single Filers | $12,950 |

| Joint Filers | $25,900 |

| Common Itemized Deductions | Description |

| Medical Expenses | Expenses exceeding 10% of AGI |

| State and Local Taxes (SALT) | Capped at $10,000 |

| Mortgage Interest | Interest on primary and secondary homes |

Future Implications and Tax Law Changes

Tax laws and rates are subject to change, and such changes can impact take-home pay. For instance, adjustments to tax brackets, the standard deduction, or available deductions and exemptions can alter the amount of taxes owed. Staying informed about potential tax law changes and consulting with a tax professional can help individuals and employers prepare for and adapt to these changes.

Potential Impact of Tax Reform

Tax reform efforts can lead to significant changes in tax laws, affecting both state and federal income taxes. Changes might include alterations to tax brackets, deductions, exemptions, or tax credits. Understanding these changes and how they apply to individual circumstances is essential for accurately calculating take-home pay and making informed financial decisions.

How do I accurately calculate my take-home pay in Illinois?

+To accurately calculate your take-home pay in Illinois, consider using an Illinois pay calculator that accounts for both state and federal taxes, as well as any deductions or exemptions. Ensure the calculator is updated with the current tax rates and laws. Alternatively, consult with a tax professional who can provide personalized advice based on your specific income and circumstances.

What factors can affect my take-home pay in Illinois?

+Several factors can affect your take-home pay in Illinois, including your gross income, filing status, deductions and exemptions, and both state and federal tax rates. Other factors such as changes in tax laws, additional income sources, and itemized deductions can also impact your take-home pay. Regularly reviewing and adjusting your tax strategy can help maximize your take-home pay.