How Much Take Home Pay Nyc? Find Your Net Income

New York City, known for its high cost of living and complex tax system, can make it challenging for individuals to determine their take-home pay. Understanding how much of your gross income you can expect to take home is crucial for budgeting and financial planning. In this article, we will delve into the factors that affect take-home pay in NYC, provide a step-by-step guide on how to calculate your net income, and discuss the implications of NYC's tax environment on your finances.

Understanding Gross Income vs. Net Income

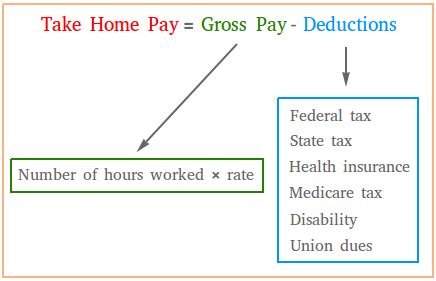

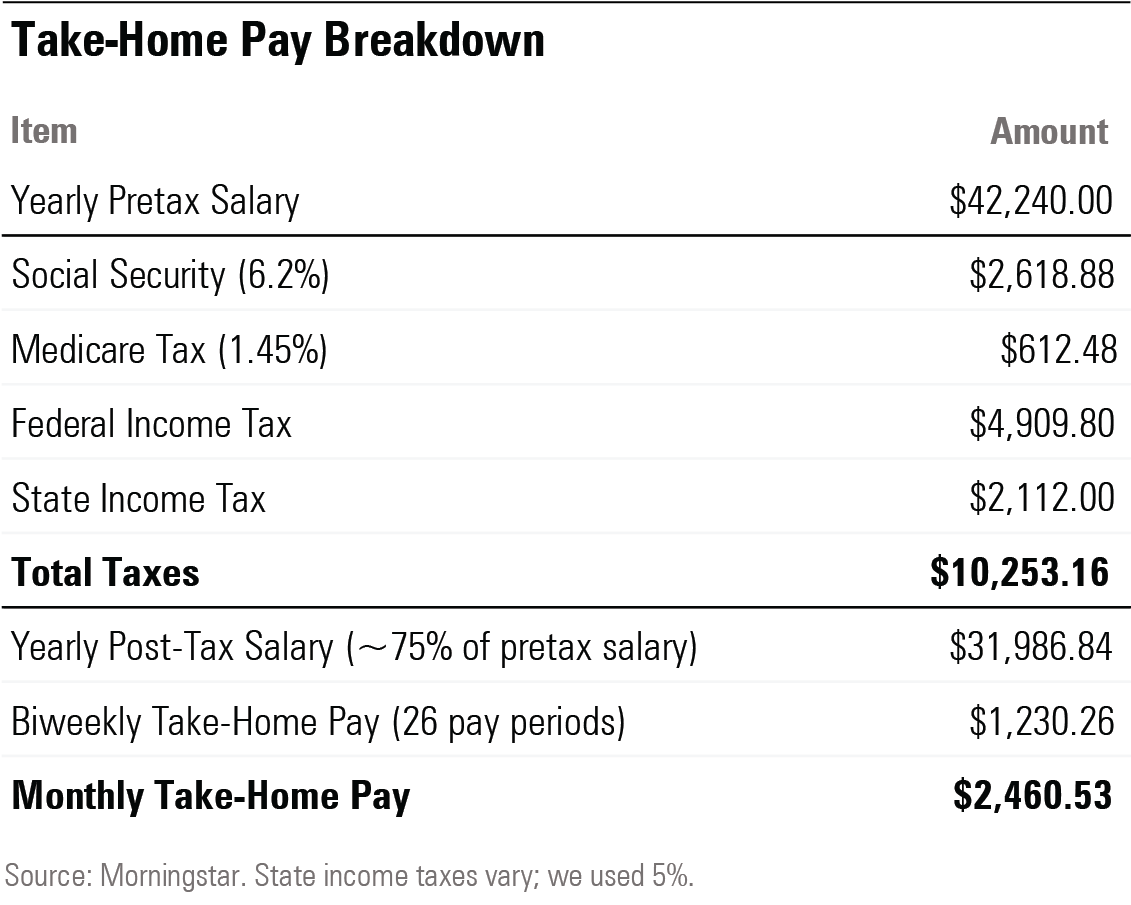

Gross income refers to your total earnings before any deductions, such as taxes, health insurance premiums, and retirement contributions. Net income, on the other hand, is your take-home pay after all deductions have been subtracted from your gross income. The difference between gross and net income can be substantial, especially in a city like New York, where taxes are higher compared to other parts of the United States.

Tax Factors Affecting Take-Home Pay in NYC

Several tax factors contribute to the difference between gross and net income in NYC. These include:

- Federal Income Tax: The federal government taxes income at progressive rates, ranging from 10% to 37%. The amount of federal income tax withheld from your paycheck depends on your filing status, number of dependents, and tax deductions.

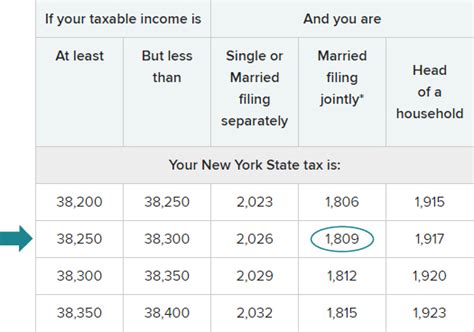

- New York State Income Tax: New York State has a progressive income tax system with rates ranging from 4% to 8.82%. The state tax rate you pay depends on your income level and filing status.

- New York City Income Tax: NYC imposes an additional income tax, known as the New York City personal income tax, with rates ranging from 2.907% to 3.648%. This tax is withheld from your paycheck if you live or work in NYC.

- Other Deductions: Other deductions, such as health insurance premiums, retirement contributions, and life insurance premiums, can also reduce your take-home pay.

Calculating Your Net Income in NYC

To calculate your net income in NYC, follow these steps:

- Determine your gross income: Start with your annual salary or hourly wage.

- Calculate federal income tax: Use the IRS tax tables or a tax calculator to estimate your federal income tax liability.

- Calculate New York State income tax: Use the New York State tax tables or a tax calculator to estimate your state income tax liability.

- Calculate New York City income tax: Use the NYC tax tables or a tax calculator to estimate your city income tax liability.

- Calculate other deductions: Estimate your other deductions, such as health insurance premiums and retirement contributions.

- Calculate your net income: Subtract your total deductions (federal income tax, state income tax, city income tax, and other deductions) from your gross income.

| Income Level | Gross Income | Federal Income Tax | NY State Income Tax | NYC Income Tax | Other Deductions | Net Income |

|---|---|---|---|---|---|---|

| $50,000 | $50,000 | $6,500 | $2,500 | $1,500 | $2,000 | $37,500 |

| $75,000 | $75,000 | $12,000 | $4,500 | $2,500 | $3,000 | $53,000 |

| $100,000 | $100,000 | $20,000 | $6,500 | $3,500 | $4,000 | $66,000 |

Implications of NYC’s Tax Environment on Finances

NYC’s high tax environment can have significant implications on your finances. Progressive taxation means that higher income earners are taxed at a higher rate, which can reduce their take-home pay. Additionally, the city’s high cost of living can make it challenging to save for retirement, pay off debt, or achieve long-term financial goals.

However, NYC also offers various tax deductions and credits that can help reduce your tax liability. For example, the New York State Earned Income Tax Credit (EITC) provides a refundable credit to low- and moderate-income workers. Understanding these tax deductions and credits can help you optimize your finances and reduce your tax burden.

What is the average take-home pay in NYC?

+The average take-home pay in NYC varies depending on income level, job title, and industry. However, according to data from the US Bureau of Labor Statistics, the average annual salary in NYC is around $71,000, with a take-home pay of around $53,000.

How can I reduce my tax liability in NYC?

+To reduce your tax liability in NYC, consider taking advantage of tax deductions and credits, such as the New York State EITC, charitable donations, and retirement contributions. You can also consult a tax professional to optimize your tax strategy.

In conclusion, calculating your take-home pay in NYC requires considering various tax factors, including federal, state, and city income taxes, as well as other deductions. By understanding these factors and using the steps outlined in this article, you can accurately estimate your net income and make informed financial decisions. Remember to consult a tax professional or use tax preparation software to ensure accuracy and optimize your tax strategy.