H&R Block Key Code: Unlock Discounts

H&R Block is a well-established tax preparation company that offers a range of services to help individuals and businesses with their tax needs. One way to save money on their services is by using an H&R Block key code, which can unlock discounts and promotions. In this article, we will explore the different types of key codes available, how to use them, and the benefits of using H&R Block for tax preparation.

What is an H&R Block Key Code?

An H&R Block key code is a unique code that can be used to access discounts and promotions on H&R Block’s tax preparation services. These codes can be found on the H&R Block website, through email promotions, or by contacting H&R Block directly. Key codes can be used for a variety of services, including tax preparation, audit support, and tax planning.

Types of H&R Block Key Codes

There are several types of H&R Block key codes available, each with its own unique benefits and discounts. Some of the most common types of key codes include:

- Tax Preparation Key Codes: These codes can be used to receive discounts on H&R Block's tax preparation services, including federal and state tax returns.

- Audit Support Key Codes: These codes can be used to receive discounts on H&R Block's audit support services, which can help individuals and businesses navigate the audit process.

- Tax Planning Key Codes: These codes can be used to receive discounts on H&R Block's tax planning services, which can help individuals and businesses plan for future tax obligations.

Each type of key code has its own unique benefits and discounts, so it's essential to choose the right code for your specific tax needs.

How to Use an H&R Block Key Code

Using an H&R Block key code is a straightforward process. Simply follow these steps:

- Visit the H&R Block website and select the service you want to use.

- Click on the "Apply Key Code" button and enter your key code.

- Review the discount or promotion associated with your key code and confirm that you want to apply it to your service.

- Complete the checkout process and pay for your service.

It's essential to note that key codes can only be used once and are subject to expiration dates, so be sure to use your code before it expires.

| Key Code Type | Discount | Expiration Date |

|---|---|---|

| Tax Preparation Key Code | 10% off federal and state tax returns | December 31, 2024 |

| Audit Support Key Code | 20% off audit support services | June 30, 2024 |

| Tax Planning Key Code | 15% off tax planning services | September 30, 2024 |

Benefits of Using H&R Block for Tax Preparation

H&R Block is a well-established tax preparation company with a reputation for providing high-quality services. Some of the benefits of using H&R Block include:

Tax preparation expertise: H&R Block's tax professionals have the knowledge and experience to help individuals and businesses navigate the complex tax code and ensure that they are taking advantage of all the deductions and credits they are eligible for.

Convenience: H&R Block offers a range of services, including online tax preparation, in-person tax preparation, and audit support, making it easy to find a service that fits your needs and schedule.

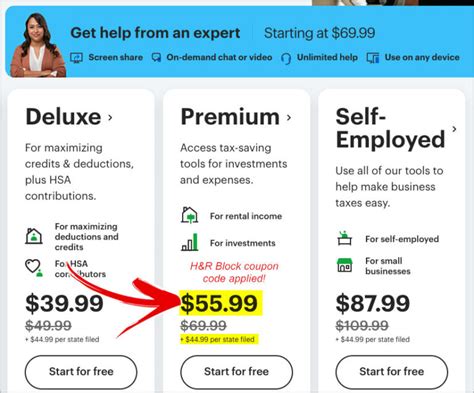

Affordability: H&R Block offers competitive pricing for its services, and with the use of key codes, individuals and businesses can save even more money on their tax preparation needs.

Real-World Examples of H&R Block Key Codes in Action

Here are a few examples of how H&R Block key codes can be used in real-world scenarios:

For example, let's say you are a small business owner who needs to file a federal and state tax return. You can use an H&R Block tax preparation key code to receive a 10% discount on your tax preparation services. This can help you save money on your tax preparation needs and ensure that you are taking advantage of all the deductions and credits you are eligible for.

Another example is an individual who is facing an audit and needs audit support services. They can use an H&R Block audit support key code to receive a 20% discount on their audit support services. This can help them navigate the complex audit process and ensure that they are represented fairly.

How do I find an H&R Block key code?

+You can find H&R Block key codes on the H&R Block website, through email promotions, or by contacting H&R Block directly. You can also check with your employer or financial institution to see if they offer any exclusive key codes.

Can I use multiple key codes at once?

+No, you can only use one key code per service. However, you can use multiple key codes for different services. For example, you can use a tax preparation key code for your federal and state tax returns and an audit support key code for your audit support services.

How long are key codes valid for?

+Key codes are subject to expiration dates, which vary depending on the type of key code and the service being used. Be sure to review the terms and conditions associated with your key code to ensure that you understand the expiration date and any other limitations.

In conclusion, H&R Block key codes can be a valuable tool for individuals and businesses looking to save money on their tax preparation needs. By understanding the different types of key codes available, how to use them, and the benefits of using H&R Block for tax preparation, individuals and businesses can make informed decisions about their tax preparation needs and ensure that they are taking advantage of all the deductions and credits they are eligible for.