Georgia Paycheck Calculator: Accurate Taxes

The Georgia paycheck calculator is a vital tool for individuals and businesses to accurately calculate taxes and understand the intricacies of the state's tax system. Located in the southeastern United States, Georgia has a diverse economy with major industries in logistics, film production, and agriculture. With a growing population and a thriving business environment, it's essential to comprehend the tax implications of earning a paycheck in the state. In this comprehensive guide, we will delve into the specifics of the Georgia paycheck calculator, exploring how it works, the factors that influence tax calculations, and providing expert insights into maximizing tax efficiency.

Understanding Georgia State Taxes

Georgia has a progressive state income tax system, with six tax brackets ranging from 1% to 5.99%. The tax rates apply to taxable income, which is calculated by subtracting deductions and exemptions from gross income. The state tax rates are as follows:

- 1% on the first 1,000 of taxable income</li> <li>2% on taxable income between 1,001 and 3,000</li> <li>3% on taxable income between 3,001 and 5,000</li> <li>4% on taxable income between 5,001 and 7,000</li> <li>5% on taxable income between 7,001 and 8,000</li> <li>5.99% on taxable income above 8,000

Factors Influencing Tax Calculations

Several factors can impact tax calculations in Georgia, including:

- Filing status: Taxpayers can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Gross income: This includes all income earned from employment, investments, and other sources.

- Deductions and exemptions: Taxpayers can claim deductions for items like charitable donations, mortgage interest, and medical expenses, as well as exemptions for themselves, their spouses, and dependents.

- Tax credits: Georgia offers various tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, which can reduce tax liability.

| Tax Bracket | Tax Rate | Taxable Income |

|---|---|---|

| 1 | 1% | $0 - $1,000 |

| 2 | 2% | $1,001 - $3,000 |

| 3 | 3% | $3,001 - $5,000 |

| 4 | 4% | $5,001 - $7,000 |

| 5 | 5% | $7,001 - $8,000 |

| 6 | 5.99% | $8,001 and above |

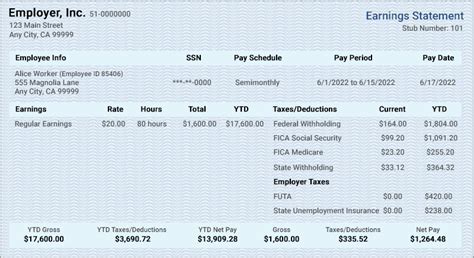

Georgia Paycheck Calculator: How it Works

The Georgia paycheck calculator is a tool designed to calculate the amount of taxes withheld from an employee’s paycheck. The calculator takes into account the employee’s gross income, filing status, number of exemptions, and other factors to determine the correct amount of taxes to withhold. The calculator can be used by both employers and employees to ensure accurate tax calculations and compliance with state and federal tax regulations.

Using the Georgia Paycheck Calculator

To use the Georgia paycheck calculator, follow these steps:

- Enter the employee’s gross income

- Select the filing status (single, married filing jointly, etc.)

- Enter the number of exemptions claimed

- Enter any additional income or deductions

- Calculate the taxes withheld based on the Georgia state tax rates and federal tax rates

What is the deadline for filing state taxes in Georgia?

+The deadline for filing state taxes in Georgia is April 15th of each year, unless the 15th falls on a weekend or holiday, in which case the deadline is the next business day.

Can I claim deductions for charitable donations in Georgia?

+Yes, charitable donations are deductible in Georgia, but only if you itemize your deductions. You can claim a deduction for cash and non-cash donations to qualified charitable organizations.

In conclusion, the Georgia paycheck calculator is a valuable tool for accurately calculating taxes and ensuring compliance with state and federal tax regulations. By understanding the factors that influence tax calculations and taking advantage of available deductions and credits, individuals and businesses can minimize tax liability and maximize tax efficiency. It’s essential to stay up-to-date with changes in tax laws and regulations to ensure accurate calculations and avoid potential penalties.