Ca Take Home Pay Calculator: Accurate Estimates

The concept of take-home pay, also known as net pay, is crucial for individuals to understand their actual earnings after deducting taxes and other deductions from their gross income. In Canada, the take-home pay calculator is a valuable tool that helps employees estimate their net income. This calculator takes into account various factors such as gross income, province of residence, and deductions to provide an accurate estimate of take-home pay. In this article, we will delve into the details of the Canadian take-home pay calculator, its importance, and how it works.

Understanding Take-Home Pay in Canada

In Canada, take-home pay is the amount of money an employee receives after deductions have been made from their gross income. These deductions include federal and provincial income taxes, Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and other deductions such as union dues or retirement savings plan contributions. The take-home pay calculator is essential for individuals to plan their finances, create budgets, and make informed decisions about their career and lifestyle.

Key Components of the Take-Home Pay Calculator

The Canadian take-home pay calculator considers several key components to provide an accurate estimate of net income. These components include:

- Gross income: The total amount of money earned by an employee before deductions.

- Province of residence: The province where the employee resides, as tax rates vary across provinces.

- Tax deductions: Federal and provincial income taxes, CPP contributions, and EI premiums.

- Other deductions: Union dues, retirement savings plan contributions, and other voluntary deductions.

By considering these components, the take-home pay calculator provides a comprehensive estimate of an individual's net income, enabling them to plan their finances effectively.

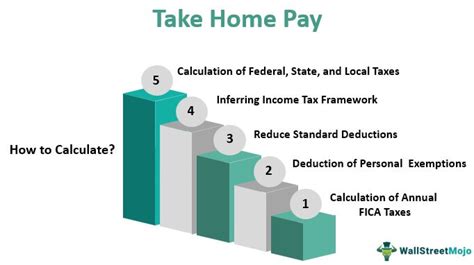

How the Take-Home Pay Calculator Works

The take-home pay calculator uses a complex algorithm to calculate an individual’s net income. The process involves the following steps:

- Gross income input: The user inputs their gross income, which is the total amount of money earned before deductions.

- Province selection: The user selects their province of residence, which determines the applicable tax rates.

- Tax deductions calculation: The calculator calculates the federal and provincial income taxes, CPP contributions, and EI premiums based on the user’s gross income and province of residence.

- Other deductions input: The user inputs any other deductions, such as union dues or retirement savings plan contributions.

- Net income calculation: The calculator subtracts the total deductions from the gross income to provide an estimate of the user’s net income.

By following these steps, the take-home pay calculator provides an accurate estimate of an individual's take-home pay, enabling them to make informed decisions about their finances.

| Province | Federal Income Tax Rate | Provincial Income Tax Rate |

|---|---|---|

| Ontario | 15% - 29% | 5.05% - 13.16% |

| Quebec | 15% - 29% | 4% - 25.75% |

| British Columbia | 15% - 29% | 5.06% - 16.03% |

Importance of Accurate Take-Home Pay Estimates

Accurate take-home pay estimates are crucial for individuals to plan their finances effectively. With a clear understanding of their net income, individuals can:

- Create realistic budgets and financial plans.

- Make informed decisions about career advancement and salary negotiations.

- Plan for retirement and other long-term financial goals.

- Manage debt and credit effectively.

By using a take-home pay calculator, individuals can ensure they have an accurate estimate of their net income, enabling them to make informed decisions about their financial lives.

Common Challenges and Limitations

While the take-home pay calculator is a valuable tool, there are common challenges and limitations to consider:

- Varying tax rates and deductions across provinces.

- Complexity of tax laws and regulations.

- Individual circumstances, such as other income sources or tax credits.

It is essential to understand these challenges and limitations to ensure accurate take-home pay estimates and effective financial planning.

What is the purpose of a take-home pay calculator?

+The purpose of a take-home pay calculator is to provide an accurate estimate of an individual's net income, enabling them to plan their finances effectively and make informed decisions about their career and lifestyle.

How does the take-home pay calculator account for tax deductions?

+The take-home pay calculator accounts for tax deductions by considering federal and provincial income taxes, CPP contributions, and EI premiums. The calculator uses a complex algorithm to calculate these deductions based on the user's gross income and province of residence.

Can the take-home pay calculator be used for all provinces in Canada?

+Yes, the take-home pay calculator can be used for all provinces in Canada. However, it is essential to note that tax rates and deductions vary across provinces, and the calculator will provide an estimate based on the user's selected province of residence.

In conclusion, the take-home pay calculator is a valuable tool for individuals to estimate their net income and plan their finances effectively. By understanding the key components, importance, and limitations of the calculator, individuals can ensure accurate take-home pay estimates and make informed decisions about their financial lives.