2. Navigate Your Payment Plans: A Comprehensive Bursar's Guide

Unveiling the Bursar's Guide: A Comprehensive Journey Through Payment Plans

Welcome to the ultimate guide to navigating the complex world of payment plans. As a student or parent, understanding the intricacies of payment options is crucial for managing your educational finances effectively. This comprehensive guide, crafted by the experts at the Bursar's Office, will illuminate the path toward financial success during your academic journey.

The journey through higher education is an exciting one, but it often comes with a hefty price tag. Payment plans are a vital tool to ensure that students can access the education they desire without being burdened by financial stress. With the right approach, you can successfully navigate these plans and make informed decisions to suit your unique circumstances.

Understanding the Basics: Payment Plans 101

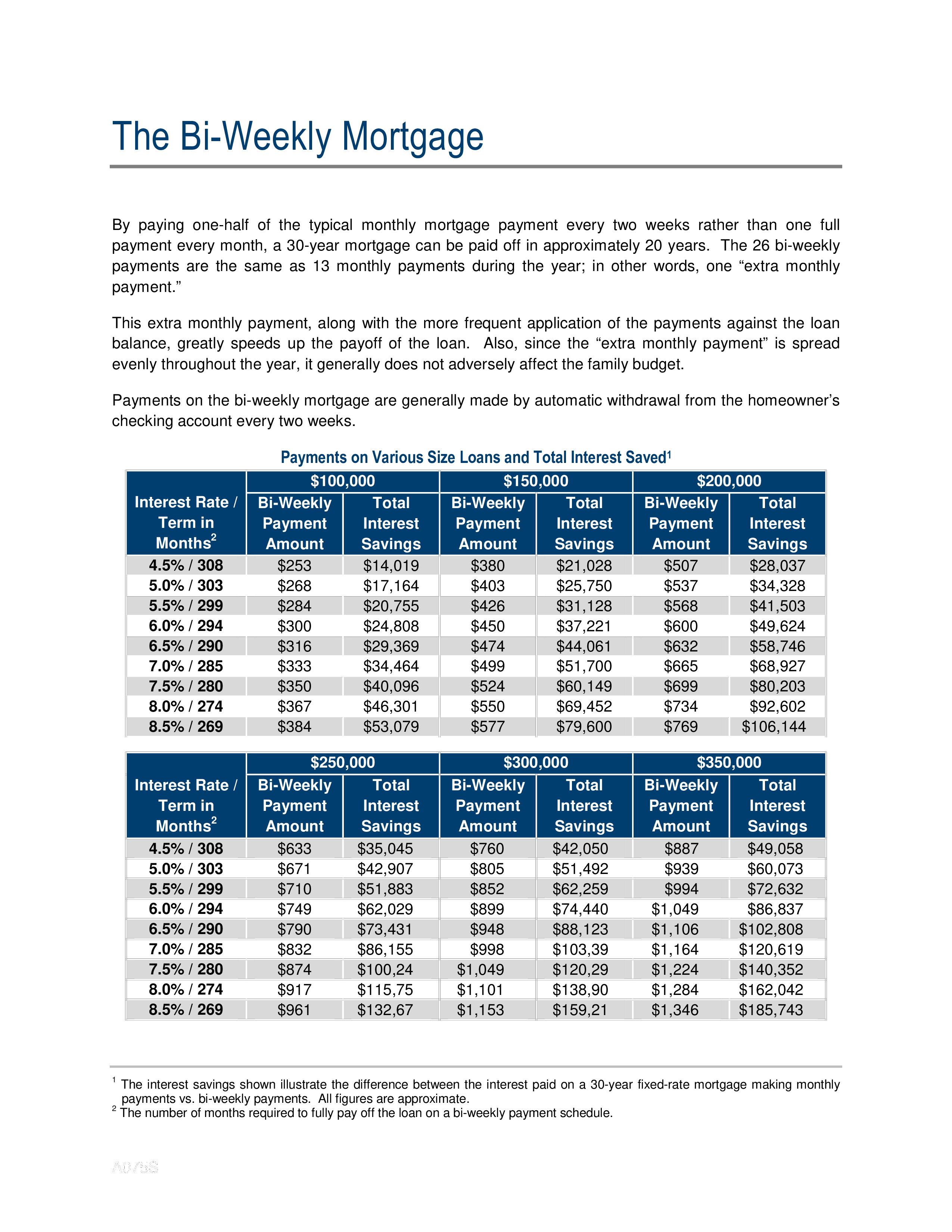

Payment plans, often referred to as tuition installment plans, are financial arrangements that allow students to pay their educational expenses in smaller, manageable installments over a specified period. These plans are designed to provide flexibility and ease the financial burden of tuition, fees, and other related costs.

At its core, a payment plan is a contract between the student (or their family) and the educational institution. This contract outlines the terms and conditions of the plan, including the amount to be paid, the frequency of payments, and any associated fees or penalties. It's a commitment to ensure that your educational expenses are covered in a timely and organized manner.

The Benefits of Payment Plans

Payment plans offer a multitude of benefits that can significantly enhance your financial stability and peace of mind during your academic journey. Here's a glimpse into some of the key advantages:

- Budgeting and Financial Control: Payment plans allow you to divide your educational expenses into smaller, more manageable chunks. This enables you to budget effectively, ensuring that you can cover your costs without being overwhelmed by a large, one-time payment.

- Interest-Free Financing: Unlike loans, which often come with interest, payment plans typically do not accrue interest. This means you won't be paying more than the agreed-upon amount, making it a cost-effective way to finance your education.

- Flexibility and Customization: Many institutions offer customizable payment plans, allowing you to choose the number of installments and the timing that best suits your financial situation. This flexibility ensures that you can align your payments with your income or other financial commitments.

- Avoidance of Late Fees and Penalties: By adhering to a structured payment plan, you can avoid the stress and financial consequences of late payments. Most institutions waive late fees and penalties as long as you adhere to the terms of your plan.

- Focus on Your Studies: With the financial aspect of your education taken care of, you can shift your focus to what truly matters: your studies. Payment plans alleviate financial stress, allowing you to dedicate your time and energy to academic pursuits.

Types of Payment Plans

Payment plans come in various forms, each designed to cater to different financial needs and circumstances. Understanding the different types available can help you choose the most suitable option for your situation.

- Semester/Term Payment Plans: These plans are typically offered on a per-semester or per-term basis. You pay a certain percentage of your total expenses at the beginning of the term, with the remaining balance divided into installments due at specified intervals throughout the term.

- Annual Payment Plans: As the name suggests, these plans cover the entire academic year. You make a down payment at the start of the year, followed by monthly or quarterly installments to cover the remaining balance.

- Monthly Payment Plans: This option allows you to pay your expenses on a monthly basis, providing the utmost flexibility. You can choose the number of months over which you wish to spread your payments, making it ideal for those with varying income streams.

- Customized Payment Plans: Some institutions offer the flexibility to design a payment plan that suits your unique financial situation. You can propose a plan that aligns with your income and expenses, subject to approval by the Bursar's Office.

Navigating the Application Process

Applying for a payment plan is a straightforward process, but it requires careful consideration and attention to detail. Here's a step-by-step guide to help you navigate the application journey:

Step 1: Research and Eligibility

Before you begin, ensure that you understand the eligibility criteria for payment plans at your institution. Some plans may have specific requirements, such as minimum enrollment status or a certain number of credit hours. Research the different plans available and choose the one that best aligns with your financial needs and capabilities.

Step 2: Gather Necessary Documents

To apply for a payment plan, you'll typically need to provide certain documents to support your application. These may include:

- A completed application form, which can usually be found on your institution's website or obtained from the Bursar's Office.

- Proof of enrollment, such as a class schedule or a confirmation letter from the registrar's office.

- Financial documents, such as bank statements, pay stubs, or tax returns, to verify your financial situation.

- Any other documentation that may be required based on the specific plan you're applying for.

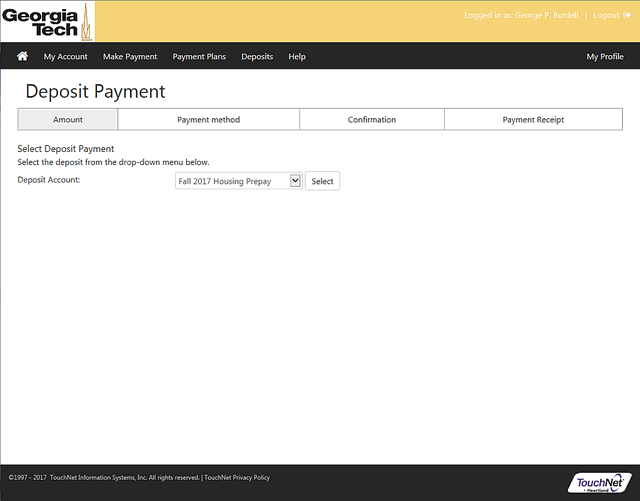

Step 3: Submit Your Application

Once you've gathered all the necessary documents, it's time to submit your application. You can typically do this online through your institution's student portal or by visiting the Bursar's Office in person. Ensure that you meet any deadlines for application submission to avoid any delays in processing.

Step 4: Review and Acceptance

After submitting your application, the Bursar's Office will review your request. This process may involve a thorough assessment of your financial situation and eligibility for the chosen plan. Be prepared to provide additional documentation or clarifications if needed.

If your application is approved, you'll receive a confirmation notice outlining the terms and conditions of your payment plan. Carefully review this document to ensure that all the details, including payment amounts, due dates, and any associated fees, are accurate and align with your expectations.

Step 5: Enroll and Set Up Payments

Once your payment plan is approved, it's time to enroll and set up your payment schedule. This process may vary depending on your institution, but it typically involves the following steps:

- Signing a contract or agreement that outlines the terms of your plan.

- Providing payment information, such as bank account details or credit card information, for automatic payments.

- Setting up reminders or notifications to ensure you stay on top of your payment schedule.

- Familiarizing yourself with the institution's policies regarding late payments, penalties, and withdrawal from the plan.

Maximizing the Benefits: Tips and Strategies

Payment plans are a powerful tool for managing your educational finances, but they require careful planning and management to ensure you maximize their benefits. Here are some expert tips and strategies to help you make the most of your payment plan:

Tip 1: Start Early and Plan Ahead

Don't wait until the last minute to explore your payment plan options. Start your research and planning early, ideally before the start of each academic year. This will give you ample time to understand the different plans, compare them, and make an informed decision.

Tip 2: Customize Your Plan

If your institution offers customizable payment plans, take advantage of this flexibility. Tailor your plan to align with your financial situation and income streams. For example, if you receive a regular stipend or have a part-time job, you can structure your payments to coincide with these income sources.

Tip 3: Automate Your Payments

To ensure you never miss a payment, consider setting up automatic payments. This way, your payments will be processed on time without the need for manual intervention. It's a convenient and reliable way to stay on track with your payment plan.

Tip 4: Explore Payment Methods

Most institutions offer a range of payment methods to accommodate different preferences and circumstances. Explore the options available, such as direct debit, credit card payments, or even mobile payment apps. Choose the method that best suits your needs and ensures a smooth payment process.

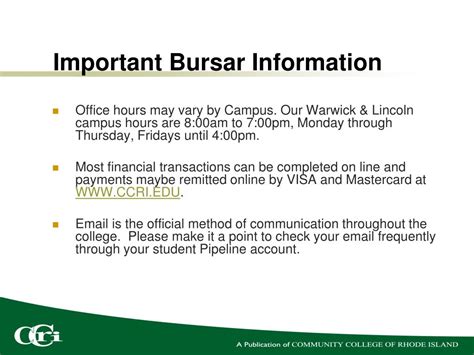

Tip 5: Stay Informed and Communicate

Stay in close communication with the Bursar's Office throughout your academic journey. Keep them informed of any changes in your financial situation or personal circumstances that may impact your ability to make payments. They can provide guidance and, in some cases, offer alternative arrangements to help you stay on track.

Addressing Common Challenges

While payment plans are designed to provide financial relief, they can also present certain challenges. Understanding these challenges and knowing how to address them is crucial for a smooth and successful payment plan experience.

Challenge 1: Late Payments and Penalties

Missing a payment or making a late payment can result in penalties and fees, which can add to your financial burden. To avoid this, set up reminders for your payment due dates and ensure you have the necessary funds available. If you anticipate a late payment, communicate with the Bursar's Office promptly to explore potential solutions.

Challenge 2: Changing Financial Circumstances

Life is full of surprises, and your financial situation may change unexpectedly. Whether it's a sudden loss of income, an unexpected expense, or a change in family circumstances, these changes can impact your ability to meet your payment plan obligations. In such cases, it's essential to reach out to the Bursar's Office as soon as possible. They can provide guidance and, in some cases, offer temporary relief or alternative payment arrangements to help you navigate through these challenging times.

Challenge 3: Withdrawing from Your Plan

If you need to withdraw from your payment plan, it's important to understand the implications and potential penalties. Some plans may require you to pay a fee or provide advanced notice. Always review the terms and conditions of your plan and communicate with the Bursar's Office to ensure a smooth withdrawal process.

The Future of Payment Plans: Innovations and Trends

The world of payment plans is evolving, with institutions continually seeking ways to enhance the student experience and provide more flexible financial options. Here's a glimpse into some of the innovations and trends shaping the future of payment plans:

Trend 1: Digital Payment Solutions

With the rise of digital technologies, institutions are embracing digital payment solutions to offer a more seamless and convenient payment experience. This includes online payment portals, mobile apps, and even blockchain-based payment systems. These digital solutions provide real-time payment tracking, instant confirmation, and enhanced security, making the payment process more efficient and user-friendly.

Trend 2: Income Share Agreements (ISAs)

Income Share Agreements are an innovative approach to financing education, gaining popularity in recent years. Under an ISA, students agree to pay a certain percentage of their future income towards their education costs. This shifts the financial risk from the student to the institution, as payments are based on the student's future earnings. ISAs provide an alternative to traditional loans and can be particularly beneficial for students who anticipate higher future earnings.

Trend 3: Refinancing and Repayment Options

Some institutions are now offering refinancing and repayment options for students who have completed their studies. These options allow graduates to consolidate their educational expenses and repayment plans, providing flexibility and potentially lower interest rates. This trend aims to ease the financial burden on graduates, making it easier to manage their repayment obligations.

Trend 4: Financial Wellness Programs

Institutions are increasingly recognizing the importance of financial wellness for students. As a result, many are implementing financial wellness programs that provide resources, workshops, and counseling to help students develop healthy financial habits. These programs aim to educate students about financial management, budgeting, and debt management, empowering them to make informed financial decisions throughout their academic journey and beyond.

Conclusion: Empowering Your Financial Journey

Payment plans are a powerful tool that can empower you to take control of your financial journey during your academic pursuits. By understanding the basics, navigating the application process, and maximizing the benefits of these plans, you can make informed decisions to suit your unique circumstances. Remember, the key to success lies in careful planning, timely payments, and open communication with the Bursar's Office.

As you embark on your educational journey, we hope this comprehensive guide has provided you with the knowledge and insights needed to navigate the world of payment plans with confidence. With the right approach, you can focus on your studies, pursue your passions, and achieve your academic goals without being burdened by financial stress.

Best of luck on your educational path, and may your financial journey be a smooth and successful one!

What are the eligibility criteria for payment plans?

+Eligibility criteria for payment plans can vary depending on the institution. Generally, you must be enrolled in a certain number of credit hours or be in good academic standing. Some institutions may also require a minimum GPA or have specific financial requirements. It’s best to check with your institution’s Bursar’s Office to understand their specific eligibility criteria.

Can I customize my payment plan to fit my financial situation?

+Yes, many institutions offer customizable payment plans to accommodate different financial circumstances. You can typically choose the number of installments, the amount of each payment, and the timing of payments to align with your income and expenses. However, keep in mind that customization may be subject to approval by the Bursar’s Office, and some plans may have specific requirements or limitations.

What happens if I miss a payment or make a late payment?

+Missing a payment or making a late payment can result in penalties and fees. The specific consequences may vary depending on your institution’s policies. In some cases, you may be charged a late fee, and your account may be placed on hold until the payment is made. It’s important to communicate with the Bursar’s Office if you anticipate a late payment to explore potential solutions and avoid any negative impacts on your academic progress.