12 Navy Chief Petty Officer Pay Hacks

The Navy's Chief Petty Officer (CPO) ranks among the most prestigious and respected positions in the military, commanding immense responsibility and influence. The journey to becoming a CPO is rigorous, and the pay and benefits reflect the critical role these leaders play in the Navy's operations. In this comprehensive guide, we'll delve into 12 effective strategies to maximize your earnings as a Navy CPO, exploring the key factors that impact your paycheck and offering expert insights to help you navigate the complex world of military compensation.

Understanding the Navy’s Pay Structure

The Navy’s pay structure for Chief Petty Officers is intricate, factoring in numerous variables such as rank, years of service, location, and specialty. The starting salary for a newly appointed CPO can vary significantly, influenced by their previous military experience and qualifications. Understanding this structure is vital to effectively planning your financial future.

Rank and Years of Service

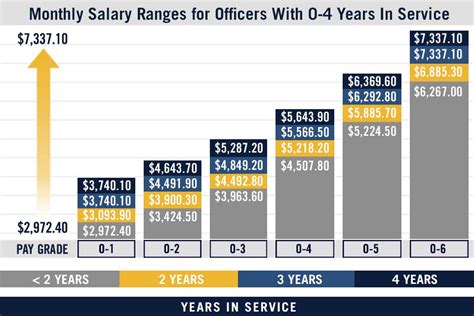

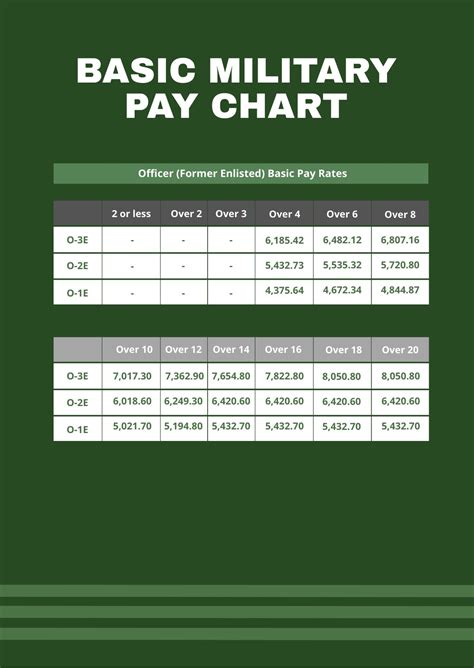

Your rank as a CPO and the number of years you’ve served are fundamental determinants of your base pay. The Navy’s pay scale, known as the Military Pay Table, outlines specific pay grades for each rank and year of service. For instance, a CPO with over 14 years of service can expect a higher salary than one with just 2 years of experience.

| Rank | Years of Service | Base Pay |

|---|---|---|

| CPO (2 years) | 2 years | $3,500/month |

| CPO (6 years) | 6 years | $4,200/month |

| CPO (14 years) | 14 years | $5,100/month |

Location and Specialty

Your duty station and specialty also impact your earnings. The Navy offers Cost of Living Allowances (COLA) for locations with a higher cost of living, and Special Pay for certain high-demand specialties or hazardous duty assignments. These additional payments can significantly boost your overall compensation.

Maximizing Your Earnings: 12 Effective Strategies

Now, let’s explore 12 strategic ways to enhance your earnings as a Navy CPO. These tactics are designed to optimize your financial well-being, taking into account the unique dynamics of military compensation.

1. Advance Your Rank

The most significant factor influencing your pay is your rank. By advancing to higher CPO ranks, such as Senior Chief Petty Officer (SCPO) or Master Chief Petty Officer (MCPO), you can command a substantially higher salary. The key to rank advancement lies in demonstrating exceptional leadership, technical proficiency, and a commitment to continuous learning and development.

2. Extend Your Enlistment

The Navy rewards longevity of service. By extending your enlistment beyond the standard term, you can increase your years of service, which directly impacts your base pay. This strategy is particularly beneficial if you’re close to reaching a new pay grade or if you’re eyeing a promotion.

3. Seek High-Demand Specialties

Certain Navy specialties are in high demand due to their critical nature or the specialized skills they require. Pursuing these specialties can lead to increased pay and benefits. For instance, specialties like Cryptology, Intelligence, or Nuclear Engineering often come with Special Pay incentives to attract and retain qualified personnel.

4. Leverage Your Education

The Navy offers various educational benefits and incentives to encourage its personnel to pursue higher education. By taking advantage of programs like the Tuition Assistance Program or the Post-9⁄11 GI Bill, you can enhance your qualifications and increase your marketability, which can lead to better pay and career opportunities, both within and outside the Navy.

5. Optimize Your Duty Station

Your duty station can significantly impact your earnings. Locations with a higher cost of living often come with a Cost of Living Allowance (COLA), which supplements your base pay. Additionally, certain duty stations may offer other incentives, such as housing allowances or access to unique training opportunities, which can indirectly boost your earning potential.

6. Explore Special Pay Opportunities

The Navy offers various types of Special Pay to recognize and reward personnel for specific skills, qualifications, or duties. These can include bonuses for foreign language proficiency, hazardous duty assignments, or critical skills such as diving or aviation. Researching and qualifying for these special pay opportunities can significantly enhance your earnings.

7. Utilize Tax Benefits

Military personnel enjoy certain tax benefits that can help boost their take-home pay. For instance, the Combat Zone Tax Exclusion allows service members to exclude certain income from taxation while serving in designated combat zones. Additionally, military personnel can often deduct certain expenses related to their service, such as uniform costs or moving expenses.

8. Maximize Your Retirement Benefits

The Navy’s retirement benefits are among the most generous in the military. By maximizing your contributions to the Thrift Savings Plan (TSP) and understanding the various retirement pay options, you can ensure a comfortable retirement. The TSP, in particular, offers tax advantages and the potential for significant growth over time.

9. Take Advantage of Military Discounts

The military community is often eligible for a wide range of discounts on goods and services, from automotive purchases to entertainment and travel. These discounts can indirectly boost your purchasing power and improve your overall financial well-being.

10. Develop Leadership Skills

Leadership roles within the Navy often come with increased responsibility and, consequently, higher pay. By developing your leadership skills and taking on positions of greater responsibility, you can not only advance your career but also increase your earning potential.

11. Stay Informed About Pay Increases

The Navy periodically adjusts its pay scales to account for inflation and other economic factors. By staying informed about these changes, you can ensure that you’re aware of any increases in your base pay. This information is typically published in the Military Pay Table, which is updated annually.

12. Negotiate for Higher Pay

In certain situations, you may have the opportunity to negotiate for higher pay. This could occur when you’re transitioning to a new duty station, applying for a promotion, or negotiating the terms of your enlistment. By highlighting your unique skills, qualifications, and contributions, you can potentially secure a higher salary.

Conclusion: A Bright Financial Future

As a Navy Chief Petty Officer, you play a vital role in the Navy’s operations, and your compensation reflects this importance. By implementing the strategies outlined in this guide, you can take control of your financial future and ensure that your hard work and dedication are appropriately rewarded. Remember, the key to maximizing your earnings lies in a deep understanding of the Navy’s pay structure and a proactive approach to your career development.

How often are Navy pay scales updated?

+The Navy’s pay scales are typically updated annually to account for inflation and other economic factors. These updates are reflected in the Military Pay Table, which outlines the base pay for each rank and year of service.

Are there any tax benefits specific to the Navy?

+Yes, Navy personnel may be eligible for certain tax benefits, such as the Combat Zone Tax Exclusion, which allows service members to exclude certain income from taxation while serving in designated combat zones. Additionally, military personnel can often deduct certain service-related expenses, such as uniform costs or moving expenses.

What is the Thrift Savings Plan (TSP) and how can it benefit me?

+The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees, including military personnel. It offers tax advantages and the potential for significant growth over time. By maximizing your contributions to the TSP, you can ensure a comfortable retirement and take advantage of the plan’s tax-deferred or tax-free growth, depending on the type of account you choose.