$12.25 Part Time Salary

The topic of part-time salaries, specifically the figure of $12.25, brings to the forefront discussions around compensation, labor laws, and the economy. Part-time employment is a significant sector of the workforce, offering flexibility that can be appealing to both employees and employers. However, the compensation for part-time work, such as a $12.25 hourly wage, can vary widely depending on the industry, location, and specific job requirements.

Understanding Part-Time Employment and Compensation

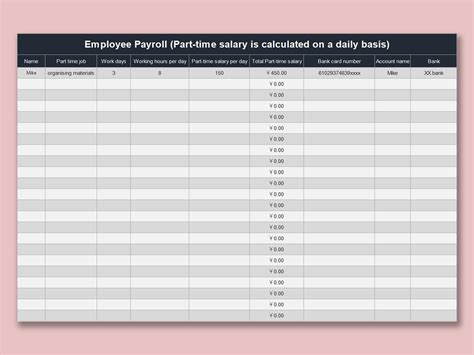

Part-time employment is characterized by working fewer hours than a full-time worker. The definition of part-time can vary between countries and even between companies, but it generally involves working less than 30-35 hours per week. The compensation for part-time work, such as 12.25 per hour, must be understood within the context of the local minimum wage laws, cost of living, and industry standards. In many places, part-time workers are entitled to the same minimum wage protections as full-time workers, meaning that 12.25 would be above the minimum wage in some jurisdictions but might be considered low in areas with a higher cost of living.

Industry Variations and Wage Standards

Different industries have varying wage standards for part-time workers. For example, retail, hospitality, and food service industries might offer lower hourly wages compared to IT, healthcare, or financial services, where specialized skills are required. A $12.25 hourly wage might be competitive in certain sectors but below par in others. Understanding these industry norms is crucial for both employers looking to attract and retain talent and employees seeking fair compensation for their work.

| Industry | Average Part-Time Hourly Wage |

|---|---|

| Retail | $10.50 - $14.00 |

| Food Service | $9.00 - $12.00 |

| Healthcare | $15.00 - $25.00 |

| IT | $20.00 - $35.00 |

Economic and Legal Considerations

The economic context, including the cost of living, unemployment rates, and inflation, significantly influences what is considered a fair wage. Legally, employers must adhere to minimum wage laws and regulations regarding overtime, breaks, and worker protections. In the United States, for example, the Fair Labor Standards Act (FLSA) sets federal minimum wage standards, but states and cities can have higher minimum wages. A $12.25 hourly wage for part-time work would need to comply with these laws and consider the economic conditions of the specific location.

Future Implications and Trends

Looking ahead, there are trends and discussions around increasing the minimum wage to a living wage, which could impact part-time salaries. The concept of a living wage is based on the income needed to cover basic family expenses, and it varies by location. If minimum wages are adjusted to reflect living wage standards, part-time workers could see significant increases in their hourly wages, potentially surpassing $12.25 in many areas. Additionally, the gig economy and remote work trends are changing the nature of part-time and full-time work, with implications for how compensation is structured and calculated.

What factors influence part-time salary rates?

+Factors influencing part-time salary rates include industry standards, location, cost of living, minimum wage laws, required skills, and experience. Employers also consider benefits, training opportunities, and work environment when determining compensation packages.

How does a $12.25 part-time salary compare to average wages?

+A $12.25 hourly wage for part-time work can be competitive in certain industries and locations but may be below average in others. It's essential to compare this wage to industry standards, local minimum wages, and the cost of living in the specific area to determine its competitiveness.

In conclusion, a part-time salary of $12.25 per hour must be evaluated within the context of the industry, location, and current economic and legal landscape. As discussions around fair compensation, living wages, and worker protections continue, it’s likely that part-time salaries will evolve to reflect these considerations, impacting both employers and employees in the part-time workforce.